Stocks and real property are both great investment options, but each has its unique advantages and disadvantages. These are the key differences: Liquidity and Risks. Location is important. Profits are crucial. If you are looking for a long-term passive income stream, investing in real estate might be a better choice. Real estate can also offer a passive income stream, as well as substantial appreciation. Stocks on the other side are susceptible to inflation, market, and economic risks. Although stocks can be bought or sold quickly, they do not require large cash investments.

Profits

There are many benefits to investing in real estate. For starters, real estate can create cash flow. Cash flow is the money left after expenses are paid. Rental income will help you offset expenses and put money in your pocket. The more time you own a home, the better your cash flow. There are a number of tax deductions and tax breaks available for real estate. These tax breaks allow you to deduct reasonable expenses related both to ownership and operation.

Investing is real estate gives investors the freedom they seek. You can slowly build a portfolio, and then supplement your income with rental income. Fixed-and-flip profits can also be your main source income. Real estate gives you the flexibility and freedom to manage your properties according to your schedule. Plus, you are your own boss. You are in control of your work hours and you have no salary limitations.

There are always risks

It is important to be able to distinguish between the risks associated with real estate investing and stocks. Real estate investment is much safer than stocks. Real estate offers a much lower risk of loss as your land serves as collateral. On the other hand, stocks are more liquid, so you can cash out at any time. Stocks can also generate income from dividends. However, investors need to be aware of volatility in stock prices as this can affect emotional decisions.

In addition to being higher risk, you will have to wait for your return to see a positive impact. Stocks typically return between 3 and 4 percent per annum, while real property returns around 10%. If you are able to put down 20% or more of the property's worth, you can still expect a 20% annual yield. This is much higher than you might get from stocks. You may also find it difficult to find properties of good value and then sell them at a lower price than what you paid. If you sell your property in a very short time, you may face a tax penalty that is equal to the average return on the real estate industry.

Liquidity

Liquidity is the ease at which an investor can turn their investment into cash. Stocks are more liquid and can be sold at regular market hours. It may take some time to sell all of your stock positions, but investors have the ability to get their money whenever and wherever they like. Real estate investments aren't as liquid and can take years to appreciate in value.

Another advantage to real estate investing is the fact that income comes from property investments and not capital gains. This makes it easier to do so. The income component automatically grows with inflation. This allows investors to spend their real-estate profits faster. Another benefit of investing in real estate is that it is less volatile. Withdrawals from this type of investment are more secure, and less likely to be affected short-term volatility. Whatever your personal preferences may be, there's a strategy to fit you.

Location

Direct investing in real estate is not for everyone. You should still consider real estate if you wish to have a balanced portfolio. It is simple to invest in the stock market and manage it. Investing in real estate is also less risky than stock index funds. If you are thinking about investing in real estate, here are some tips to help you make an informed decision:

FAQ

Is it possible to get a second mortgage?

However, it is advisable to seek professional advice before deciding whether to get one. A second mortgage is typically used to consolidate existing debts or to fund home improvements.

What should I look for in a mortgage broker?

A mortgage broker is someone who helps people who are not eligible for traditional loans. They shop around for the best deal and compare rates from various lenders. This service is offered by some brokers at a charge. Others provide free services.

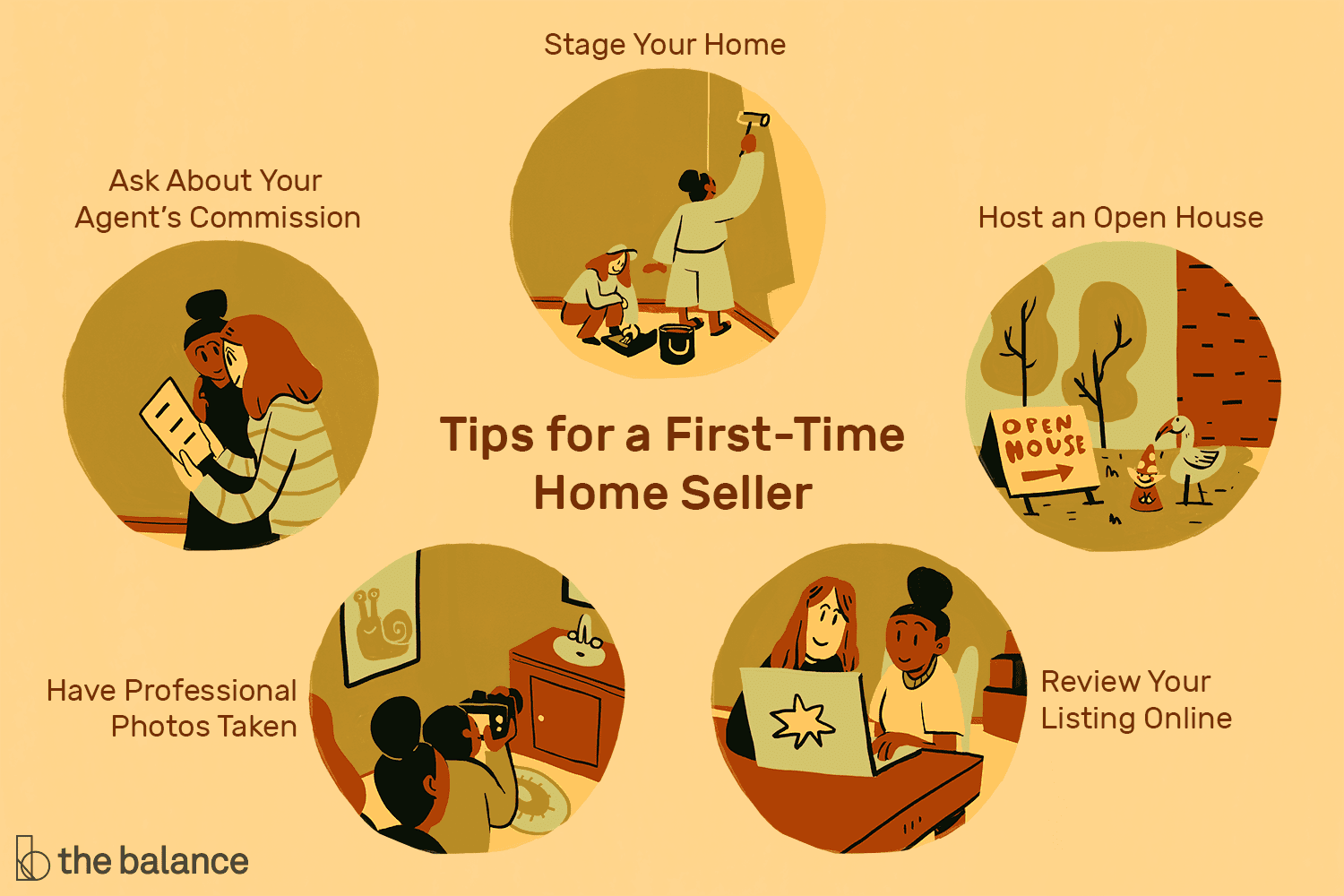

How long does it take for my house to be sold?

It depends on many factors, such as the state of your home, how many similar homes are being sold, how much demand there is for your particular area, local housing market conditions and more. It can take anywhere from 7 to 90 days, depending on the factors.

What amount of money can I get for my house?

This can vary greatly depending on many factors like the condition of your house and how long it's been on the market. The average selling price for a home in the US is $203,000, according to Zillow.com. This

How much does it take to replace windows?

Windows replacement can be as expensive as $1,500-$3,000 each. The cost to replace all your windows depends on their size, style and brand.

Statistics

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

External Links

How To

How to find houses to rent

Finding houses to rent is one of the most common tasks for people who want to move into new places. But finding the right house can take some time. When it comes to choosing a property, there are many factors you should consider. These factors include price, location, size, number, amenities, and so forth.

You can get the best deal by looking early for properties. For recommendations, you can also ask family members, landlords and real estate agents as well as property managers. This will allow you to have many choices.