There are many ways to begin your career in real estate development if you're interested. These include building relationships, gaining experience, and getting relevant certifications. There are numerous online communities that enable you to connect with professionals in your industry. It really comes down to what interests or motivates you.

Building relationships

You must have relationships in order to succeed in real-estate development. As real estate developer Brian Wilson says, "You should focus on building relationships and networking. People do business when they are able to trust people they know. Establishing trust relationships with others will help you get started in real estate development.

Developers are different from traditional project managers. They work with vendors and contractors to make deals. The developer must oversee the work of other consultants, including architects, general contractors, and engineers. Successful real estate developers must be relationship builders, able to establish strong working relationships with contractors and consultants.

Education

It is crucial to learn the skills necessary for developing a career in realty, regardless of whether you are looking to develop residential properties, commercial properties, or mixed-use buildings. Working in this field requires teamwork and stakeholder engagement. The best developers are not afraid to get dirty and become deeply involved in the communities where they work. You can't replace the experience gained through hands-on learning. Clemson University's interactive program is the best way to get a grasp of the industry.

MRED covers topics that are relevant to real estate. It integrates legal and economic principles with topics such as urban design, market analysis, and history. Students can choose electives that fit their interests. The program requires that students complete an internship with real estate development.

Experience

A combination of skills and experiences is required to develop real estate properties. This includes planning and organizing projects and budgets, analyzing market trends and demography, and planning construction and marketing. In order to achieve a high-quality end product, a realty developer must be able interact with clients.

There are three main stages in real estate development: pre-development, construction, and post-development. These stages require knowledge on different types and types of real estate. Successful developers must also have experience with sales and marketing.

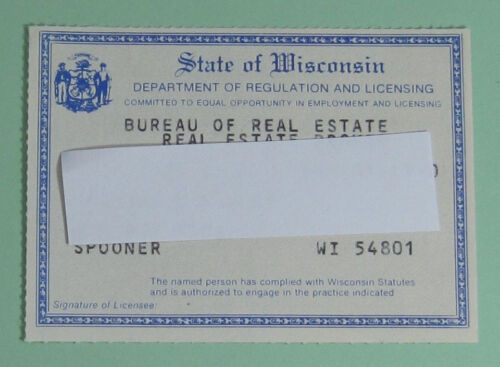

Certificates

Real estate designations and certifications can be very useful tools for anyone who is interested in getting into the real estate market. But they can be costly. These credentials can only be earned by completing specific courses and gaining professional experience. You can also find free online classes and certificates in real estate finance and development.

Real estate certifications can help you become a more successful real estate professional. These courses will be taught by experts in the industry. The program is designed to provide essential knowledge, as well as valuable insights from guest speakers. Your certificate can be earned from accredited institutions, such as the University of San Diego’s Division of Professional & Continuing Education. The faculty consists of professionals with both academic as well as professional backgrounds.

Geographic focus

Your geographic focus is key to success in real-estate development. It is also important to decide what product you will sell. You can customize your work for your target market by choosing your focus. For instance, you might concentrate on single-family homes and condominiums. This will allow you to narrow your geographic scope and concentrate on a specific area or city.

FAQ

Are flood insurance necessary?

Flood Insurance covers flooding-related damages. Flood insurance protects your belongings and helps you to pay your mortgage. Find out more information on flood insurance.

How can I calculate my interest rate

Market conditions can affect how interest rates change each day. The average interest rates for the last week were 4.39%. To calculate your interest rate, multiply the number of years you will be financing by the interest rate. Example: You finance $200,000 in 20 years, at 5% per month, and your interest rate is 0.05 x 20.1%. This equals ten bases points.

What amount of money can I get for my house?

The number of days your home has been on market and its condition can have an impact on how much it sells. Zillow.com shows that the average home sells for $203,000 in the US. This

What are the benefits associated with a fixed mortgage rate?

A fixed-rate mortgage locks in your interest rate for the term of the loan. This means that you won't have to worry about rising rates. Fixed-rate loans also come with lower payments because they're locked in for a set term.

What should I consider when investing my money in real estate

You must first ensure you have enough funds to invest in property. If you don’t have the money to invest in real estate, you can borrow money from a bank. Aside from making sure that you aren't in debt, it is also important to know that defaulting on a loan will result in you not being able to repay the amount you borrowed.

It is also important to know how much money you can afford each month for an investment property. This amount should cover all costs associated with the property, such as mortgage payments and insurance.

It is important to ensure safety in the area you are looking at purchasing an investment property. You would be better off if you moved to another area while looking at properties.

How much does it take to replace windows?

Replacement windows can cost anywhere from $1,500 to $3,000. The exact size, style, brand, and cost of all windows replacement will vary depending on what you choose.

Statistics

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

External Links

How To

How to be a real-estate broker

You must first take an introductory course to become a licensed real estate agent.

Next, pass a qualifying test that will assess your knowledge of the subject. This involves studying for at least 2 hours per day over a period of 3 months.

Once you have passed the initial exam, you will be ready for the final. To become a realty agent, you must score at minimum 80%.

Once you have passed these tests, you are qualified to become a real estate agent.