A commission will be charged to you if you buy or sell a property. The amount that you have to pay can be negotiated so it is worth considering before you make a decision to sell or buy a property. A real estate agent is an invaluable resource that can help you get a better price.

The buyer and seller can pay one of two types of commissions. These commissions can be paid as a flat fee or as a percentage of the sales price. You can ask about your realtor's commission when you're interviewing agents. To ensure you get the best price on your home, a good agent will work for a lower commission.

The commission paid to the seller is usually between 5-6 percent of final sale price. This number can vary depending upon the state, however it is fairly consistent. In some states, such as California, the commission is negotiable.

The commission is usually split between the seller's and buyer's agents. The listing agreement will discuss the exact split. Sometimes the commission is charged at pre-paid rates, which are cheaper. To find out who pays the realtor in your state, you can do some research.

Traditionally, a commission for a realty agent is charged at time of signing the sale agreement. Some agents may charge fees for signing a deposit agreement. In these cases you may have to pay a certain percentage of the fee. You might not have the rest until the closing.

The agent's fee is not regulated by the federal government. While it isn't required, it is typically included in the price of a home. Be aware that many online realtors charge as much as 50% to sign a deed. Some agents may not accept these deals.

The seller will pay a commission, but the agent must also cover any other costs associated with the sale of the house. These expenses include listing, signage, major staging, and other costs. These expenses can also include printing materials, photography, or other costs. Before you even start to negotiate for a house, it's important that you get a fair deal.

You might be able negotiate a buyer's commission rebate. This commission is where you pay a percentage to the buyer's agent as a reward to them for bringing a qualified buyer to your house. This is a great way to attract more buyers. It can also backfire. The commission can be used to your advantage if the buyer's agent is competent.

A home purchase will generally require you to pay a large sum of money. It's why it is so important to work with a skilled real estate agent. He or she will help you to get the best price and point you in the right direction, if necessary.

FAQ

How can you tell if your house is worth selling?

Your home may not be priced correctly if your asking price is too low. If your asking price is significantly below the market value, there might not be enough interest. For more information on current market conditions, download our Home Value Report.

Do I need to rent or buy a condo?

Renting may be a better option if you only plan to stay in your condo a few months. Renting saves you money on maintenance fees and other monthly costs. On the other hand, buying a condo gives you ownership rights to the unit. You can use the space as you see fit.

What is a reverse loan?

A reverse mortgage allows you to borrow money from your house without having to sell any of the equity. It allows you to borrow money from your home while still living in it. There are two types to choose from: government-insured or conventional. If you take out a conventional reverse mortgage, the principal amount borrowed must be repaid along with an origination cost. If you choose FHA insurance, the repayment is covered by the federal government.

Statistics

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

External Links

How To

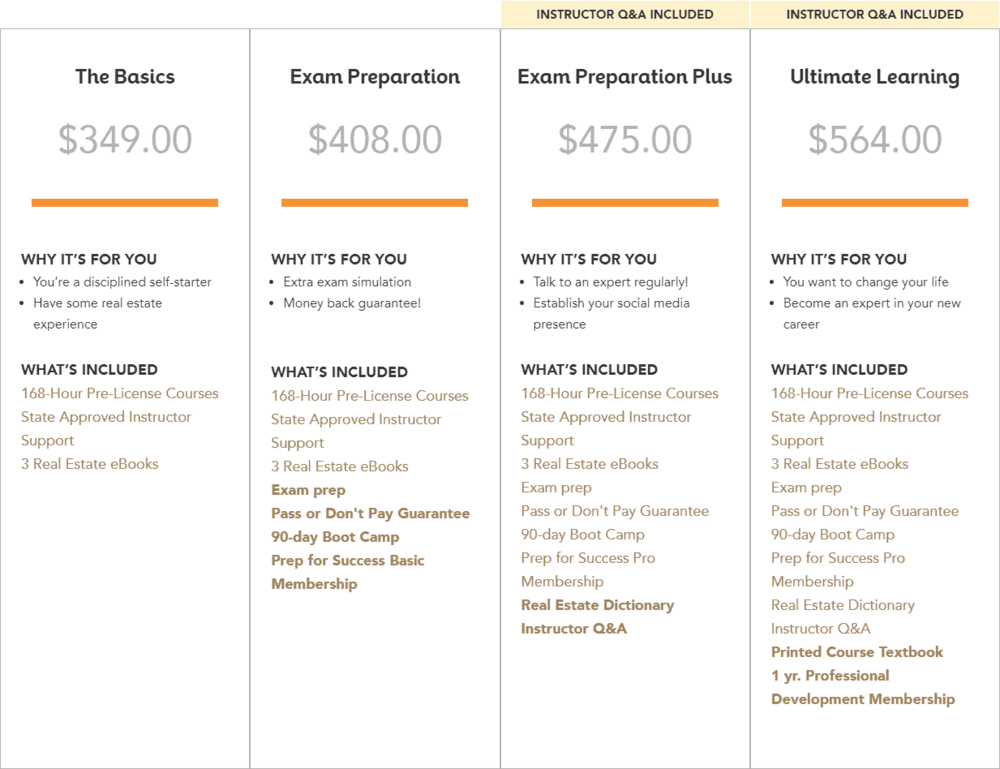

How to become a real estate broker

An introductory course is the first step towards becoming a professional real estate agent. This will teach you everything you need to know about the industry.

Next, pass a qualifying test that will assess your knowledge of the subject. This requires that you study for at most 2 hours per days over 3 months.

You are now ready to take your final exam. To become a realty agent, you must score at minimum 80%.

Once you have passed these tests, you are qualified to become a real estate agent.