You might be curious about how much a realty agent earns in commission if you're thinking of hiring one. Here are Florida's typical commission rates. An average real estate agent makes 6% of the purchase amount. However, some REALTORS may be willing to negotiate their commission rate with you if you offer a lower amount. However, this could interfere with certain marketing services. It's therefore crucial to determine how much your realtor earns, and what is fair for you.

5.40%

Florida home buyers believe they don’t have the obligation to pay a professional realtor. While the listing agent's fee is typically paid by the seller of the property, home buyers still have to pay a commission to the agent. The commission is split between seller and buyer. The fee will still be greater than the commission rate charged to other agents.

6%

For the services of a Realtor, most sellers in Florida pay a commission of 6%. The fee is split between the buyer's agent, the brokerage and the listing agent. The buyer pays the remaining 4%. This is the biggest expense for sellers. It's vital to shop around to find an agent that is qualified and willing to accept a reasonable commission. This article will explain how to negotiate the commission for a Florida Realtor.

5%

Florida home buyers often assume that they don't need a realtor to help them. But, this assumption is incorrect. Florida agents are paid both by sellers and buyers. Buyers put their own money up front. Florida has a standard 5% commission. Brokers may negotiate lower rates with their clients. Below are some ways to lower the Realtor commission rate.

2%

If you are considering selling your home, you may be wondering how much 2% of the sale price should be for the commission. Real estate agents in Florida earn an average of $13,500 for their services. This commission can be negotiable in some states, including Florida. You can actually get as little as 1% off the sale price. However, this is still a significant expense. In Florida, the commission is split between the listing agent and the buyer agent.

4%

Depending on the state in which you live, you may need to pay anywhere from four to six percent for a realtor. This may be a high number, but it does not have to be. The standard commission rate for real estate agents is about six percent, but you can negotiate with your agent to pay less. Some real estate agents even offer rebates or discounts, so you should always shop around for the best agent for your needs.

FAQ

What should I do before I purchase a house in my area?

It depends on how long you plan to live there. If you want to stay for at least five years, you must start saving now. However, if you're planning on moving within two years, you don’t need to worry.

What's the time frame to get a loan approved?

It depends on several factors such as credit score, income level, type of loan, etc. Generally speaking, it takes around 30 days to get a mortgage approved.

Do I need a mortgage broker?

A mortgage broker may be able to help you get a lower rate. Brokers have relationships with many lenders and can negotiate for your benefit. Some brokers do take a commission from lenders. Before you sign up, be sure to review all fees associated.

How can I fix my roof

Roofs can leak due to age, wear, improper maintenance, or weather issues. Minor repairs and replacements can be done by roofing contractors. Contact us to find out more.

What are the advantages of a fixed rate mortgage?

A fixed-rate mortgage locks in your interest rate for the term of the loan. This ensures that you don't have to worry if interest rates rise. Fixed-rate loan payments have lower interest rates because they are fixed for a certain term.

What should you consider when investing in real estate?

The first step is to make sure you have enough money to buy real estate. If you don't have any money saved up for this purpose, you need to borrow from a bank or other financial institution. It is important to avoid getting into debt as you may not be able pay the loan back if you default.

Also, you need to be aware of how much you can invest in an investment property each month. This amount must be sufficient to cover all expenses, including mortgage payments and insurance.

Finally, ensure the safety of your area before you buy an investment property. You would be better off if you moved to another area while looking at properties.

Statistics

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

External Links

How To

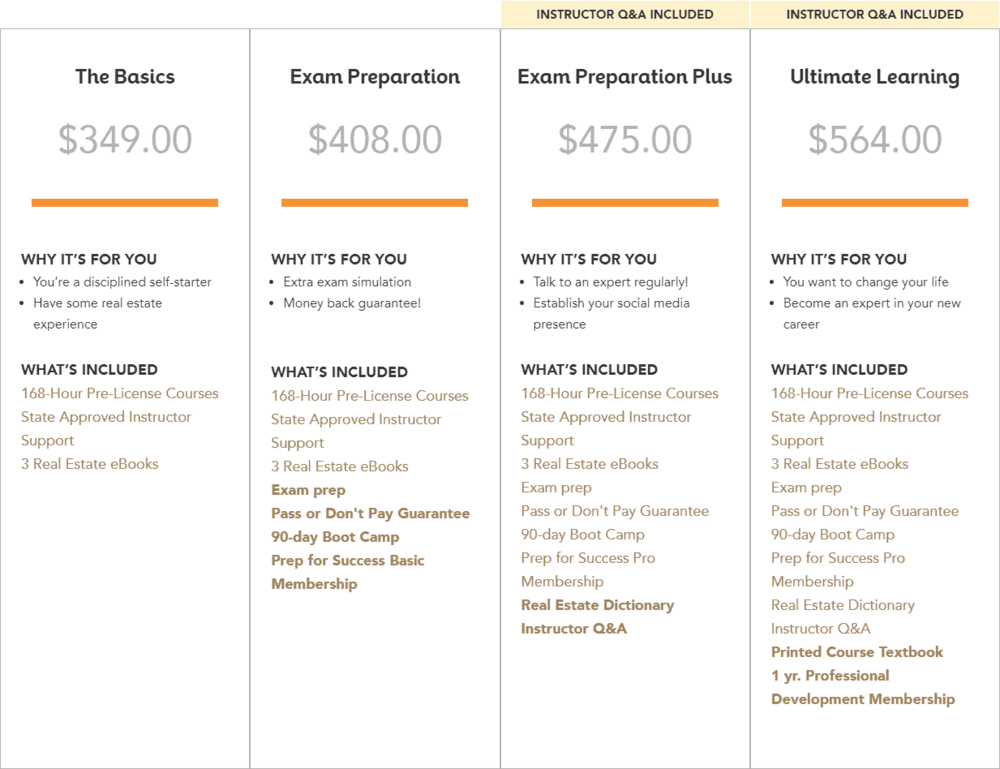

How to become real estate broker

The first step in becoming a real estate agent is to attend an introductory course where you learn everything there is to know about the industry.

Next, pass a qualifying test that will assess your knowledge of the subject. This requires studying for at minimum 2 hours per night over a 3 month period.

This is the last step before you can take your final exam. To become a realty agent, you must score at minimum 80%.

These exams are passed and you can now work as an agent in real estate.